Term Life

Insurance

Cash Value

Insurance

What is the best insurance for your family?

The debate revolves around the benefits or drawbacks of buying Cash Value life insurance (which accumulate savings as part of the policy benefits) compared to purchasing a much less expensive term life insurance policy and using the savings to pay down debt and make investments. Our intent is to focus attention on some of the often overlooked issues to help our clients make informed decisions.

Do You Need Life Insurance?

At Zander Insurance, our primary reason for offering Term Life insurance is that it provides the most

affordable option for people to purchase the life insurance they need. First and foremost, life

insurance is for protection and having the right amount of coverage is the most imperative goal.

Significantly higher cost Cash Value plans not only reduce money available for other financial

priorities but limit the amount of coverage a family can afford . . . defeating the whole purpose

of protection.

A principle concept of Cash Value plans is that people need life insurance for their whole life.

This approach promotes the idea that you will always be in debt and unable to meet the obligations

of your family. In reality, you only need life insurance for as long as your premature death represents

a financial strain to your family. If you are out of debt and have built your savings, then why do you need

to continue to pay for any type of policy? By getting rid of debt and maximizing other investment opportunities,

the need for life insurance for your whole life is eliminated.

Financial Benefits of Term Life Insurance

With guaranteed level Term Life plans offered for 15, 20, and 30 years,

the comment that Term Life plans are short term and will leave you without

protection are exaggerated. Many will point out that term life policies pay

fewer claims since they can expire while the insured is still alive. This is true . . .

but does it matter if you don't need the coverage any longer? Why is life insurance any

different than home or auto coverages that only pay if there is a claim? Guaranteed level

term life policies provide for secure and stable insurance options and allow individuals to

focus on other more beneficial financial goals.

Flexibility is often pointed out as a key benefit of Cash Value plans. Through forced savings,

expenses for education, retirement and emergency needs can be bundled together for extra protection.

This is a flawed approach since there are better investment options available for these circumstances.

Programs such as 529s and ESAs (Education Savings Accounts), along with company matching retirement plans,

401-ks, Simple IRAs and especially Roth IRAs, offer far better investment options, tax benefits and rates of

return than investing in a life insurance policy.

Flexibility is often pointed out as a key benefit of Cash Value plans. Through forced savings,

expenses for education, retirement and emergency needs can be bundled together for extra protection.

This is a flawed approach since there are better investment options available for these circumstances.

Programs such as 529s and ESAs (Education Savings Accounts), along with company matching retirement plans,

401-ks, Simple IRAs and especially Roth IRAs, offer far better investment options, tax benefits and rates of

return than investing in a life insurance policy.

The Downside of Cash Value Plans

When cash value agents use mathematical data to prove their point, they often overlook other key issues.

They never seem to take into account the cost of your continuing debt while saving in their plan. In addition,

access to your savings requires a loan and interest paid to the insurance company or a withdrawal which reduces

the policy amount if not repaid. They also overlook that only the policy death benefit is paid to the beneficiary . . .

not the savings. In the end, clients continue to be in debt, have additional costs to access their money and do not receive

their savings if they die.

The real shortcoming of Cash Value policies is that they don't address the true needs of today's American families.

We are a society strained by debt, struggling to balance our finances and responsibilities and are focused on spending.

Cash Value plans weaken our ability to overcome these challenges since their product simply perpetuates the situation instead

of helping solve it. This is a primary reason that over 50 million American families are either uninsured or underinsured today.

Determining the Best Option for You

In the end, the strategy that we undertake at Zander Insurance is to assist our clients in finding the most affordable

term life insurance plans available. This helps them focus on the ever-important process of establishing an emergency fund,

getting out of debt and seeking out high quality investment opportunities to build wealth. We understand that term insurance

is not the solution to all our client's financial needs, but simply an important part of a plan that helps maximize their

potential for financial peace and success. We hope that this information provides you a clearer picture of the reasoning for

our commitment to term life insurance and assists in your decision making process. We look forward to being of service to you.

Download the PDF of this Article

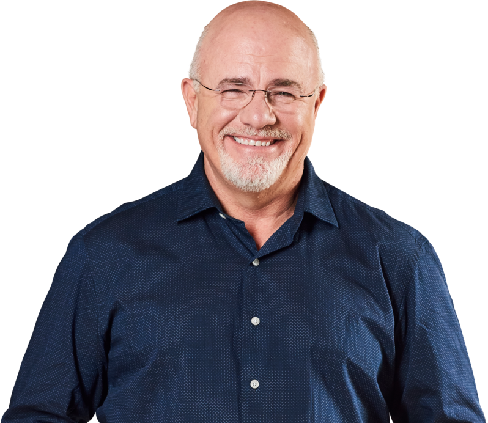

I recommend Term Life Insurance because it is the most affordable type of protection. Insurance is all about protection - not savings! Cash Value plans are just a waste. If you need access to the savings in your policy you have to borrow it and pay interest. When you die, the insurance company pays your beneficiary but keeps your savings. Don't buy cash value plans. It just doesn't make sense!

- Dave RamseyMore Helpful Insurance Information

Zander Insurance Reviews

See what others have had to say about Zander Insurance Service and Insurance.

Insurance Help Center

Visit Zanderinsurancetips.com to learn more about your options.

Dave Ramsey's Zander Review

Read what Dave Ramsey has to say about Zander Term Life Insurance

Questions?

Call a Zander Guide™

Whether you have a question or need to report an ID theft event, out U.S.-based support team is available around the clock for guidance and assistance.

1.800.356.4282